Faith-Powered Productivity

Productivity Rooted in

Purpose & Barakah

Resources, programs, and a global community helping you align your daily habits with your highest purpose.

Become the Best Version

of Yourself

True productivity isn't about doing more — it's about aligning your spiritual, physical, and social life with a higher purpose. Explore the three pillars that guide every Productive Muslim.

Productivity begins with the soul. Through mindful worship, intentional dua, and daily reflection, we align our ambitions with a higher purpose — so every task becomes an act of ibadah.

Your body is an amanah. Sleep, nutrition, movement, and energy management aren't extras — they're the foundation. A strong body fuels a focused mind and a resilient spirit.

We don't rise alone. Meaningful relationships, contribution to your community, and lifting others up are at the heart of a productive Muslim life — success shared is success multiplied.

Programs

Structured Learning for Lasting Change

Productive Muslim Certification

Shawwal 11, 1447 AH · Mar 30, 2026Become a certified Productive Muslim trainer and join a global network. 12 months of ongoing support, expert training, and the opportunity to serve the Ummah through faith-based productivity.

Learn More →

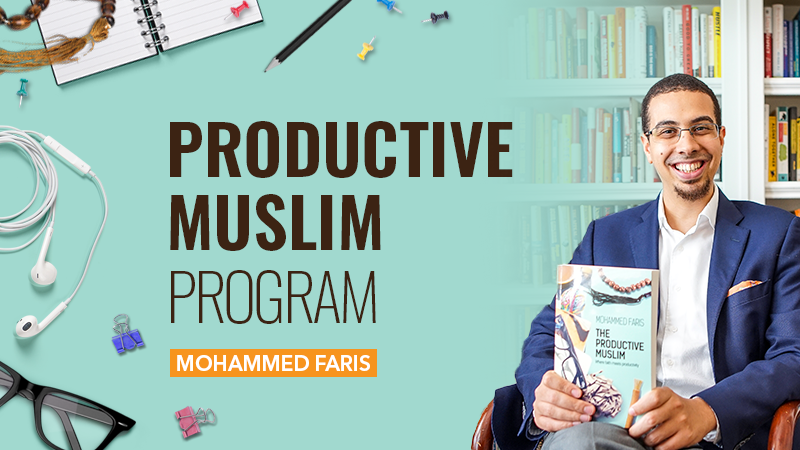

The Productive Muslim Program

Shawwal 27, 1447 AH · Apr 15, 2026A faith-based productivity transformation for high-performing Muslim professionals. A complete paradigm shift that transforms how you approach work, life, and success through the lens of Islamic wisdom combined with peak performance science.

Learn More →Community

Join a Global Muslim Network

A Community for Muslim Changemakers

Mastermind calls, book clubs, accountability circles, and a private network of Muslims building meaningful careers — without losing their souls to hustle culture.

Virtual Coworking for Muslim Professionals

Live focus sessions designed for spiritual and professional excellence. Start with Bismillah, work in deep focus, end with reflection — alongside fellow Muslims worldwide.

Testimonials

Voices from the Community

Walked in skeptical. Walked out converted. Thank you for your professional coaching service. Clarity and revived relentlessness. Proper coaching = 1. Skepticism = 0. Thank you!

What I learned from Productive Muslim gave me the courage to take the leap and to leave the results to Allah SWT and to be vulnerable that I'm gonna make mistakes and that it's okay.

I can really, really feel the impact of converting from Hustle Culture to Barakah Culture and I now understand how spirituality can be the source of power of my many roles as a woman.

Undoubtedly, one of the greatest scholars of our time! My team and I, have found Mohammed's teachings transformative in the way we approach work, life and our connection to the Divine.

Your team, your community, your organisation, will benefit from this. Increasing our productivity is a vital task if we are to change our situation and Mohammed and the ProductiveMuslim team help us achieve it.

Mohammed Faris has combined the best of productivity science, positive psychology, and Islamic guidance into a course that goes beyond the book. Weekly experiments, resources, and his own life experiences have made this course worthwhile.

Products

Tools for Your Journey

Articles